As you may know, Congress passed a stimulus bill in March, 2021, officially called the American Rescue Plan. The bill has many provisions, but three tax provisions in particular will affect the calculations in Family Law Software, especially for the 2021 tax year, with significant impact on cash flow, taxes, and child support. This will […]

Category: General

Which Year’s Numbers Should I use?

People ask which year’s numbers they should use for guidelines and budgets: last year’s? This year’s? Next year’s? The year you use depends on the purpose for which you are using the results. Guidelines. For child and spousal support guidelines, people tend to use current year numbers. However, since the guideline payment amount tends to […]

Accurate Net Income

In marriage dissolution cases, the alimony and child support you calculate depend on the parties’ net incomes. “Net income” Seems like a simple concept. But sometimes it is not so simple to figure out the amount of money that is actually available to spend. Often during divorce, the client who will be required to pay […]

When parents share parenting time equally in New York, how do you calculate child support? Family Law Software give you a quick and easy way to come up with the right answer. In New York, the “custodial parent” who has more than equal time with the children, pays the “non-custodial parent” child support under the […]

When parents share parenting time equally in Connecticut, how do you calculate child support? Family Law Software give you a quick and easy way to come up with the right answer. Under the Connecticut law, “Shared Physical Custody” means that the physical residence of the child is shared by the parents for “a substantially equal […]

A discussion of child support calculation in NJ where there is equally shared parenting time- and how Family Law Software can help.

Equal Parenting in Colorado

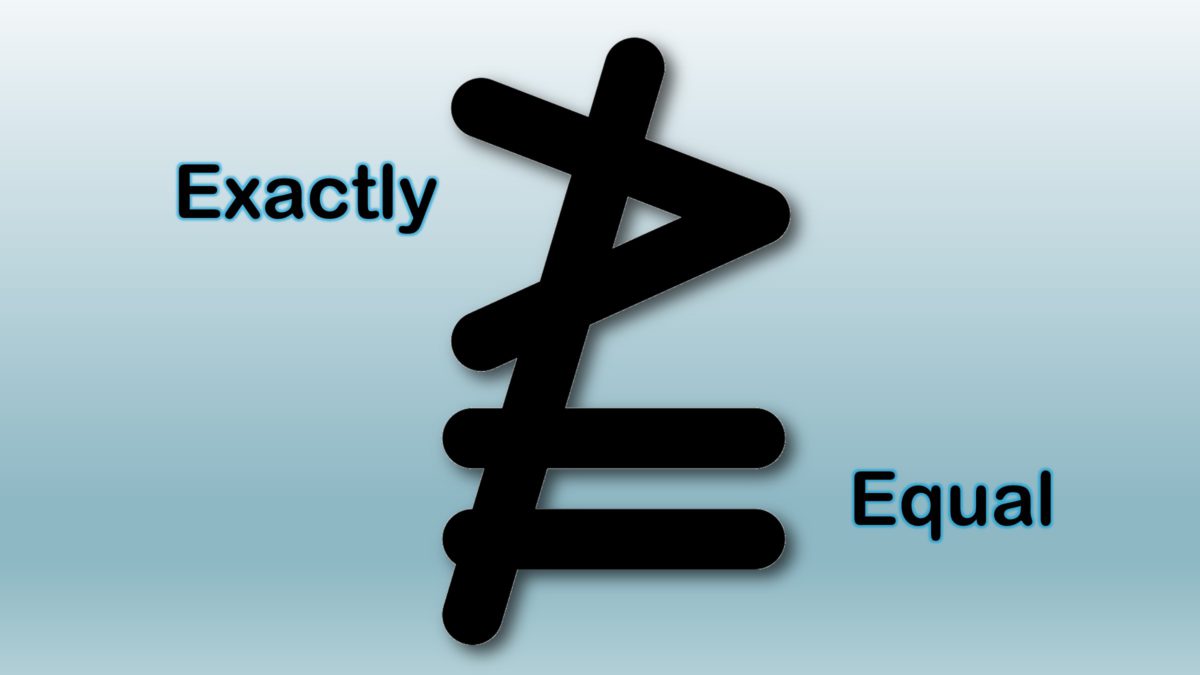

Many state child support statutes are fuzzy when parents have exactly equal parenting arrangements. Let’s consider Colorado, for one example. In Colorado, the question is whether we should calculate exactly equal parenting as “shared” or as “split” custody. Under the statute, “shared” physical care means that each parent keeps the children overnight for more than […]

As the global pandemic began to impact the U.S. economy, Congress passed sweeping legislation in an attempt to deal with the anticipated fallout. First, Congress passed the Families First Coronavirus Response Act (FFCRA). Shortly thereafter Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Between the two acts there are provisions that […]

Let’s look at the hypothetical case of a state trooper who has been working 10 years. His accrued pension benefit is $2,500 a month. If he works another 10 years, his accrued pension benefit will be $4,500 a month. He is 52 years old and seems likely to work until regular retirement at age 62. […]

There might be a case in which the alimony payor lives in a state which does tax alimony at the state level, but the recipient lives in a state which does not. In order to indicate that the payor would receive the state tax deduction and the recipient will pay no state income tax on […]