“No one is PAR”. “Both Parents are PPR”. “Everything is equally shared”. These are common statements we get in inquiries concerning calculation of NJ Child Support when parents have exactly equal parenting time. Unfortunately, there isn’t a calculation specific to this increasingly common situation- but- Family Law Software provides the tools to help determine you determine a fair outcome:

What the Law says:

At R5:6A, Appx. IX-A, 14 the NJ Child Support Guidelines state (in part): “The parents should be referred to as the Parent of Primary Residence (PPR) and the Parent of Alternate Residence (PAR)…The designation of PPR and PAR is not related to the gender of either parent or the legal designation of custodial parent…If the time spent with each parent is equal (50% of overnights each) the PPR is the parent with whom the child resides while attending school. Overnight means the majority of a 24-hour day (i.e. more than 12 hours).”

But what if the child attends school while residing with each of the parents? The Rule is silent, and there is no further guidance.

The Calculation Matrix:

Use of the NJ Child Support Guidelines is required as a “Rebuttable Presumption” for every child support calculation to establish or modify child support (see R5:6A, Appx. IX-A, 2). The Rule-specified Sole and Shared Parenting worksheet matrices have columns for PPR and PAR data- someone’s information must be inserted into each column in order to use the Guidelines. In exactly equal parenting time cases, we therefore suggest running scenarios with Both parents taking turns as PPR & PAR within a Shared Custody calculation.

The Variables for Scenarios:

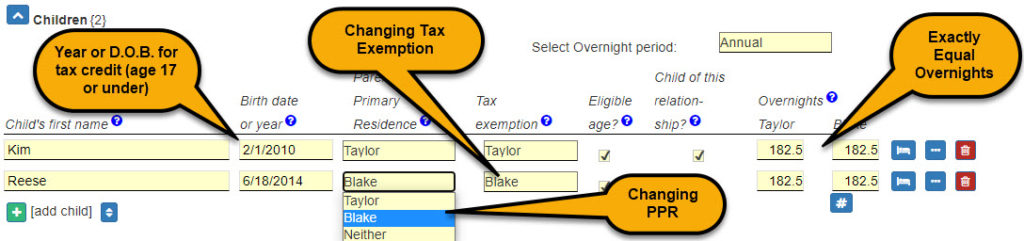

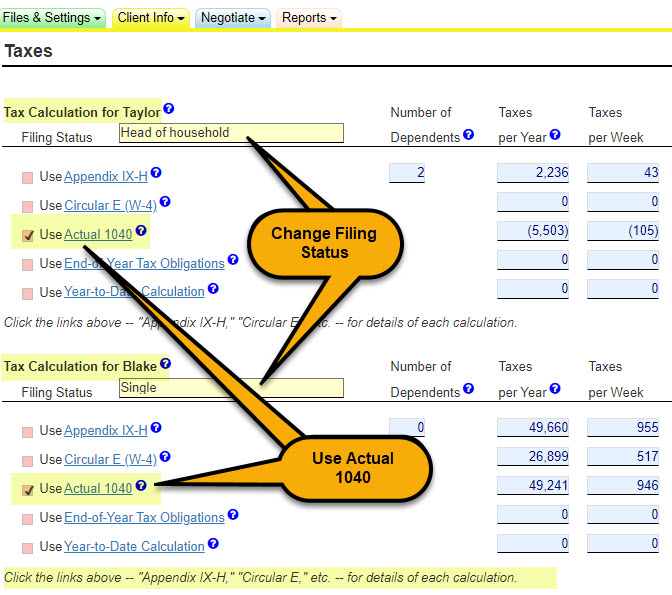

Besides specifying each Parent as PPR in a given scenario, you may also wish to tweak your scenarios by changing the tax filing status of the PPR to Head of Household and the PAR as Single. And equally as important under current tax law, specify that each parent take the child(ren) as their dependent for purposes of the Federal Child Tax Credit (which was a tax credit worth up to $2000/year/child in 2020 and recent years-click here for more information). Under the 2021 American Rescue Plan (ARP) tax changes, the credit can be worth thousands more in 2021- see our blog post on the ARP here.

In Family Law Software, on the yellow Enter Data tab, click Child Support Data, then open the Children section:

On the Enter Data tab, click Child Support Data, then scroll down and open the Deductions section. Scroll to 3. Taxes then click the link to see the Tax Worksheets:

Create Manual Scenarios:

Enter your data for a base scenario (say, Party A as PPR). Click the green Files & Settings tab> Open/Save/Send link. Scroll down to the Save As button and click it. Give the case a new name for the 2nd scenario where Party B will be PPR and click OK. Now change the PPR for all children and other variables as desired, in the new case. Compare the worksheets from each scenario.

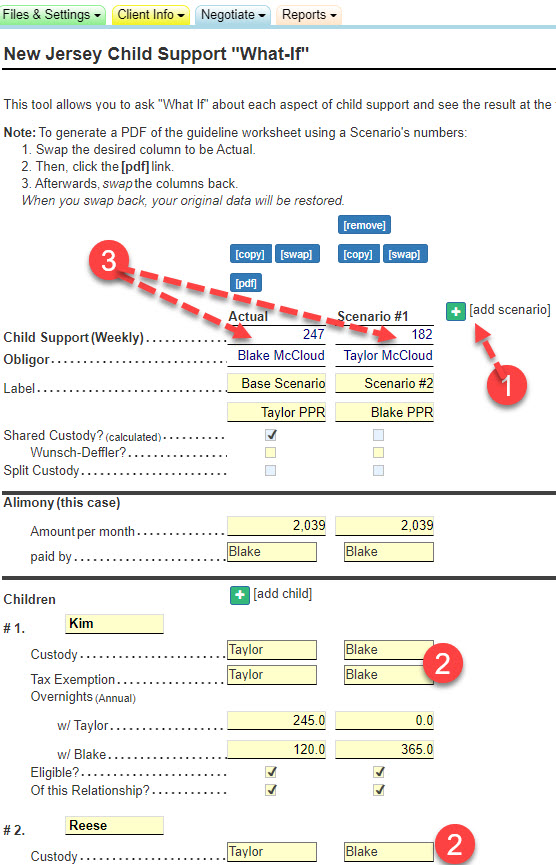

Create Auto Scenarios Side-by-Side Using the Support What if? Tool (Full & Cloud Versions only):

Enter your data for a base scenario (say, Party A as PPR) in the usual manner. Click the blue Analysis tab> Support “What if” (desktop software) or What if for Child Support (cloud software) in Family Law Software. Click the green add scenario button (#1 below). Change the Custody for all children to Party B in the second scenario (#2 below), together with any other variables you want to test in that scenario’s column. Repeat add scenario and create as many additional scenarios as you like. Compare the support awards at the top of each scenario (#3 below).

Strategy #1: The “Wunsch-Deffler” method:

The NJ Guidelines, at R5:6A, IX-B, 14, f. , state (in part):

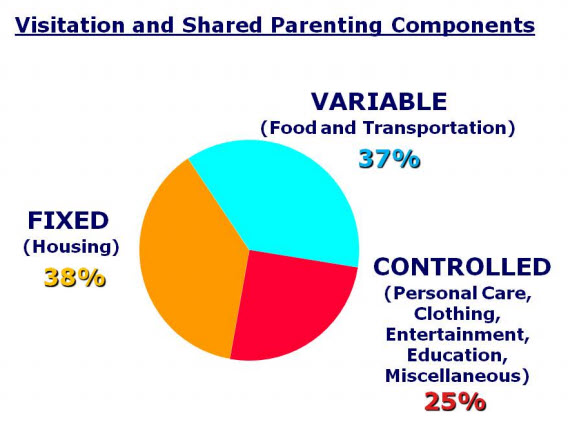

…It is assumed that controlled expenses for the child are incurred only by the PPR since, generally, that parent manages the day-to-day needs of and expenditures for the child. The Appendix IX-F awards may not be appropriate in shared-parenting situations since they assume that the PPR incurs all expenses for the child and that the PAR has no expenses related to the child. To arrive at a fair support award in shared-parenting situations, the Appendix IX-F awards may need to be adjusted to accommodate each parent’s time adjusted fixed and variable expenses for the child. Since it is assumed that only the PPR incurs controlled expenses, the adjustment formula provides that such costs are shared by the parents in proportion to their relative incomes only, not in proportion to time spent with the children…

The controlled expenses represent 25% of every support award- therefore, even in a Shared Custody computation, whichever parent is designated PPR will have 25% of every support dollar reserved to them.

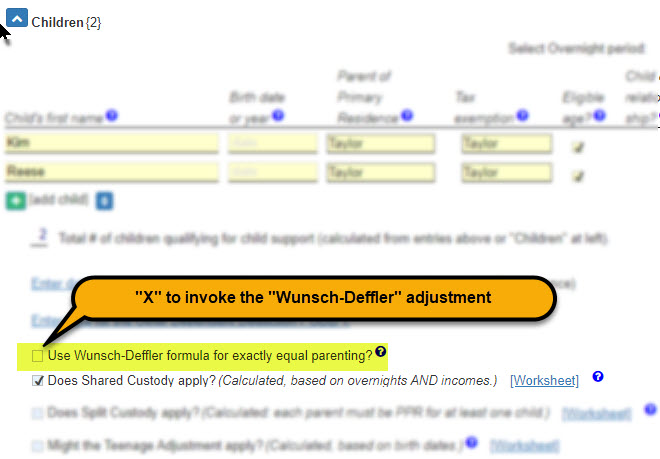

The Wunsch-Deffler v. Deffler case is a NJ Superior Court Published Opinion (406 N.J. Super. 505; 968 A.2d 713; 2009 N.J. Super.). It seeks to mathematically return the controlled expenses portion of a Shared Custody support award to be split equally between the parents when the children are shared equally (thereby removing the assumption quoted above). Many people feel that the Wunsch-Deffler approach is the better method of handling child support in exactly equal parenting time situations. By popular demand, we built the Wunsch-Deffler formula into the software and explain the math results on our Shared Custody worksheets on line #15 when the Wunsch-Deffler control is selected (you can find it in our support calculator just beneath where the children are entered- see below).

You may wish to consider trying the Wunsch-Deffler calculation with each parent taking turn as PPR to see if you can find an equitable result from averaging the results from those two calculations. Running either the standard Shared Parenting or the Wunsch-Deffler Shared Parenting calculations will still ensure that the Shared Parenting Household Income Test (see, R5:6A, IX-B, 14 d & e) is calculated correctly- unlike running two Sole Custody calculations.

Strategy #2: Cross-Crediting:

I am a big fan of Richard A. Russell, Esq. whose tireless work as Chair of the NJ Supreme Court Family Practice Committee, Child Support Sub-Committee, where the survey research underpinning the NJ Guidelines was studied in detail. Rich has developed a unique expertise that indisputably makes him the “Godfather of the Guidelines” in NJ. He is not a fan of the Wunsch-Deffler approach described above. He feels that it may often lead to a greater reduction in the support award than is just in equally shared parenting situations.

Instead, Rich supports the concept of “cross-crediting” by performing two Shared Custody calculations with exactly equal overnights- one with each parent taking a turn as PPR- and then averaging the two results to determine the difference between the two. The lower result is then subtracted from the higher, with the difference being the possible support award owed by the parent with the higher award.

(This is very similar to how the NJ Guidelines approach Split custody calculations at R5:6A, IX-B, 15., except that in Split calculations, where one or more of the children is assigned to each parent as their PPR, two Sole Custody calculations are performed and then the same averaging of the two support awards as described above takes place. Split Custody calculations are NOT recommended in exactly equal parenting cases since they are based upon the Sole Custody worksheet matrix which doesn’t adjust for the Fixed expenses in both households and does not include the Shared Parenting Household Income Test which is required in any Shared Parenting case).

Consider the Fairness of ANY Adjustments:

At R5:6A, IX-A, Philosophy of the Child Support Guidelines, the Guidelines state (in part):

…children should not be the economic victims of divorce or out-of-wedlock birth. The economic data and procedures of these guidelines attempt to simulate the percentage of parental net income that is spent on children in intact families. While it is acknowledged that the expenditures of two-household divorced, separated, or nonformed families are different from intact-family households, it is very important that the children of this State not be forced to live in poverty because of family disruption and that they be afforded the same opportunities available to children in intact families with parents of similar financial means as their own parents….

And at R5:6A, IX-A, 14. Shared Parenting Arrangements:

Although these guidelines are designed to accommodate shared-parenting arrangements when appropriate, shared-parenting adjustments or awards are not presumptive, but are subject to the discretion of the court in accordance with the factors listed in paragraphs 14(c) and 14(d).

see https://www.njcourts.gov/attorneys/assets/rules/app9a.pdf, pages 1 and 15-20 for context)

The Shared Parenting concepts attempt to adjust child support in recognition of the fact that children spend a large amount of time (if not equal time) in the households of BOTH parents. While parenting time may be equal, finances in disturbed or never-formed households may not. Before considering Shared Parenting or Adjustments to accommodate Equally Shared Parenting, it is important to consider the impact of adjusting or reducing child support when one of the households is at a significant economic disadvantage. Ensuring that children have a good standard of living while in BOTH households should be a primary concern.

While certainly not binding in New Jersey, there is some guidance in the Pennsylvania Child Support Guidelines at 1910.16-4 (c) (2) for equal parenting time calculations:

“…Without regard to which parent initiated the support action, when the children spend equal time with both parents, the Part II (Shared Custody) formula cannot be applied unless the obligor is the parent with the higher income. In no event shall an order be entered requiring the parent with the lower income to pay basic child support to the parent with the higher income…”

This approach protects the finances of lower income household and also definitively decides which parent Is the Obligor in virtually all cases.

Conclusion:

Equally Shared Parenting seems to be an increasingly popular custodial arrangement- in NJ and elsewhere. Hopefully, the NJSC Family Division Practice Committee will someday soon take a long, hard look at equally-shared custody calculations and definitively decide how to amend the Guidelines to specifically address the PPR/PAR designation and a present a formula for Equally Shared Parenting calculations. Until then, examining and comparing support calculations as described above will yield the analysis necessary to help determine fair and just support awards in such cases. While the software can help with the analysis, careful consideration of what is equitable and just for the parties and in the best interests of the children, remains the sole discretion of Attorneys, Mediators and the Courts.