As you may know, the NJ Supreme Court annually orders revisions to the NJ Child Support Guidelines (R5:6A).

Those revisions often include changes to how taxes are to be computed when using the Appx. IX-H Combined Tax Tables and the IRS Circular E tax calculation (both are tax estimates- Appx. IX-H is limited to Single Tax filers and simple wage income cases while the Circular E covers all other tax filing statuses as well as income situations such as self-employment, rental income, taxable alimony income, non-taxable income, etc.). Based upon your inputs for filing status and/or income types, Family Law Software (FLS) defaults to either the Appx. IX-H calculation or the Circular E calculation automatically in an effort to emulate how the Court’s software behaves.

Before the June 1, 2020 revisions, a special calculation in Rule 5:6A was used to adjust the number of typically claimed tax withholding exemptions to account for the Federal Child Tax Credit. Effective June 1, 2020, the Rule now says to refer to the W-4 forms filed by the parties to determine the correct number of ,“dependent children eligible for the federal income tax credit”, and use that figure in the Appx. IX-H and Circular E tax estimates.

This change is determining tax dependents and the child tax credit was accompanied by changes to the methods and tables used to calculate taxes via either Appx. IX-H, and the IRS Circular E.

As a result, new Appx IX-H and Circular E tax estimate calculations in FLS for NJ were completely updated. The results of these new calculations can be quite different than those done in previous years. In some cases, the results will be higher or lower taxes despite using the same income. In low to moderate income cases, the Federal Child Tax Credit may actually exceed the amount of federal tax owed, resulting in a $0 Federal Tax liability for the custodial parent (PPR) who will claim the Child Tax Credit (In 2020 currently, $2000 per year per qualifying child under the age of 17 for individuals earning less than $200,000/year or $400,000/year for married filing jointly. For 2021, boosted even higher via the American Rescue Plan).

FLS’s tax defaults were set-up to emulate what the Court’s software did when choosing Appx. IX-H or Circular E tax estimates. However, it’s not clear when the Court’s software will be updated to comply with the new Court Rule. As a result, there may be differences in the Court’s tax estimates and those in FLS. This may also apply to other software used to calculate NJ child support.

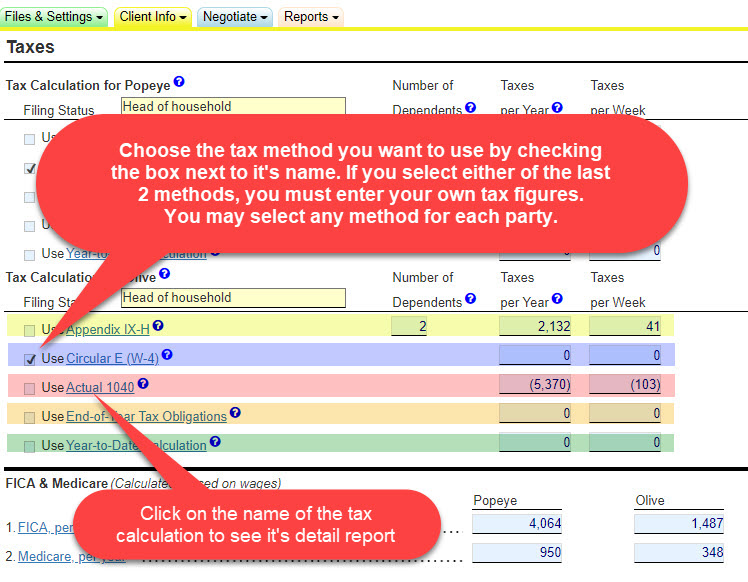

FLS users are free to use any of 3 built-in tax calculations- the Appx. IX-H Combined Tax Table estimate, the IRS Circular E tax estimate or FLS’s native 1040 tax calculation (the 1040 is an actual tax calculation- not an estimate). Or, users may input information from last year’s tax returns or estimate taxes based upon at least six months of income and tax records from current pay stubs or pay statements.

To access the various tax selections for child support calculation in NJ: Click the yellow Client Info tab (now called Enter Data tab) , then click the Child Support Data link (in the Desktop software, that link is on the left of the screen; in the Cloud version of FLS the link is accessed by clicking the yellow Client Info tab, then selecting it from the drop-down menu that appears). On the Main Screen scroll down and open the Deductions section. Inside Deductions scroll down to 3. Taxes and click the link Click here to view the worksheets for taxes. You’ll then be able to select the tax method you desire to use or write-in tax figures you determine yourself:

(NOTE: When using the DESKTOP software, if your screen does not show 3. Taxes and the link Click here to view the worksheets for taxes under the Deductions heading, you need to Update your software to the newest version: https://www.familylawsoftware.com/update/ )

Rule 5:6A does not specify what tax method should be used (see the instructions for Line 2a- Withholding Taxes on pages 10 & 11 here: https://www.njcourts.gov/attorneys/assets/rules/app9b.pdf).

The Rule specifically mentions the Appx. IX-H Combined Tax Tables, and the End-of-Year or Year-to-Date entries. In general, it states that each parents’ combined weekly federal, state and local withholding taxes should be used. FLS includes the “Actual 1040” calculation that will calculate the actual end-of-year taxes for the current year, which we recommend.

If you have additional questions about NJ Child Support Tax calculations or choices, please let us know.

Thanks for using FLS!